MP urges exchequer to consign immoral death tax policy to farmyard manure heap

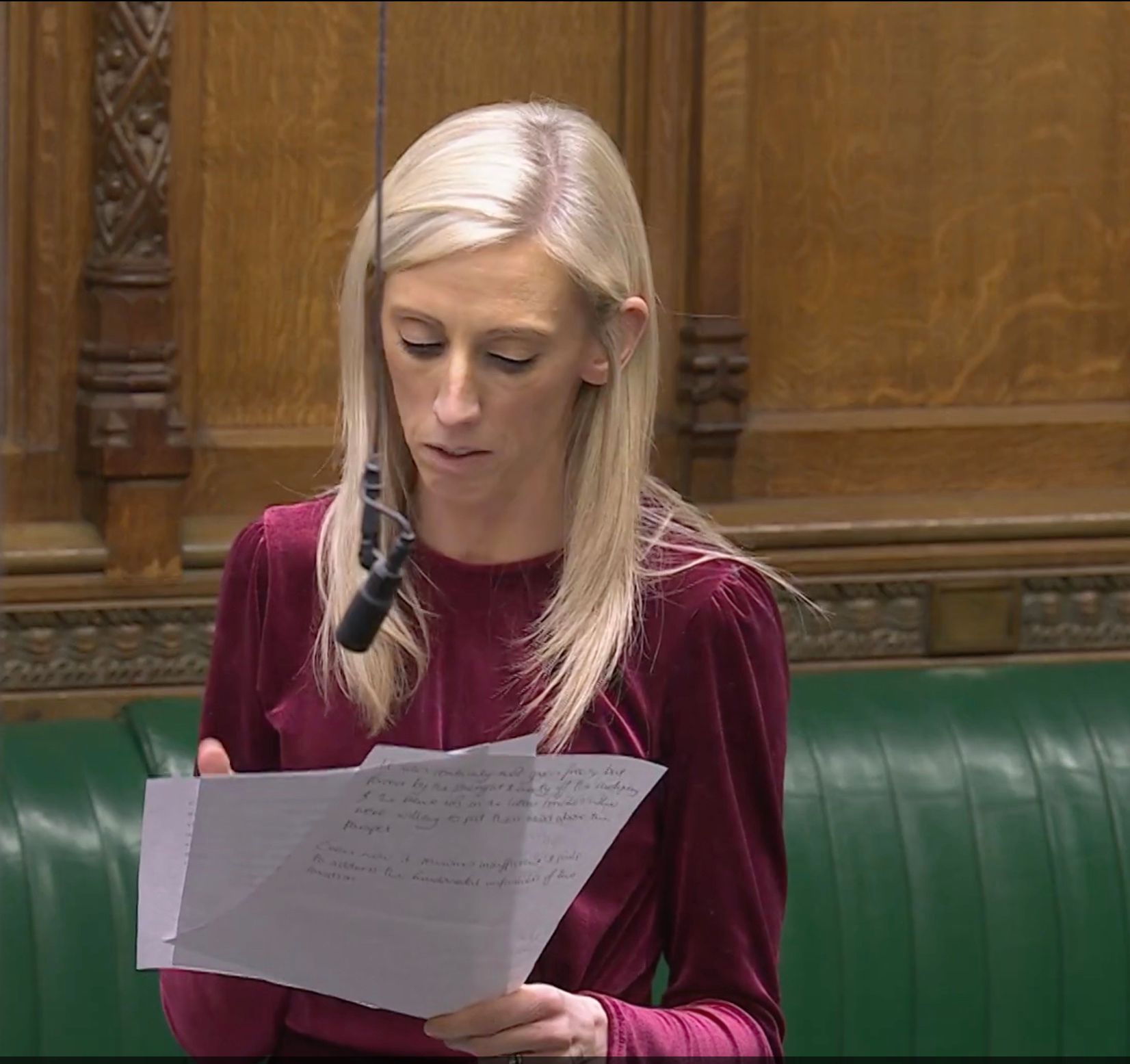

DUP Agriculture spokesperson, Carla Lockhart MP, has challenged the Labour Government to do the honorable thing regarding its immoral inheritance tax reforms.

During this week’s Finance Bill debate in Westminster, the Upper Bann MP said: “Politics is about doing the right thing, and the Exchequer secretary to the Treasury, Dan Tomlinson, knows he should consign this policy to the farmyard manure heap.

“If the government doesn’t, it must accept the lasting damage that this policy will inflict on farms, family businesses, rural communities and national food security.

“The government has been tone-deaf on this issue for 14 months, and has refused to listen to farming unions and stakeholders. In the wake of all this, would Mr Tomlinson honour his previous commitment meet the Ulster Farmers’ Union to discuss the out-workings?

Since the 2024 Budget Carla Lockhart has stood shoulder to shoulder with farmers from Northern Ireland and across the UK. She said: “They have lobbied, protested and spoken with one voice in defence of their livelihoods and their family farms. It has been my greatest honour to come alongside and fight this battle with them.

“Increasing the threshold from £1m to £2.5 million represents a hard-won concession. It was forced by the strength and unity of the farming community, and by the courage of the minority on the Labour back benches. Even so, it remains wholly insufficient and fails to address the fundamental unfairness that remains embedded in the Bill.

“Ultimately, the DUP, and indeed, members right across the Ulster benches, want to see this policy scrapped in totality,” added the MP. “That is why I support amendment 3 and the linked amendments 4 to 23, which would delay these changes to March 2027.

“Farming families planned succession responsibly and in good faith under the rules as they stood; changing those rules mid-stream is unjust and destabilising, and it undermines confidence across the entire sector.”

Ms Lockhart added: “New clause 7 seeks to address a glaring omission in the government’s approach: the failure to index-link or uprate the APR allowance. Agricultural land values have risen sharply. In recent months, land in my constituency was sold for £32,000 per acre, demonstrating the value of land in Northern Ireland and the impact that this Bill will have on our farms.

“Those land values do not arise from the effort of the farmer, and farm incomes have not kept pace. A static threshold in a rising land market guarantees that more and more family farms will be dragged into the inheritance tax net year after year. Index-linking is not radical; it’s common sense - something this government appears to be lacking.”

The MP also highlighted amendment 43, which would retain 100% business property relief where a property has been owned for at least 10 years as part of a genuine, actively operated family business.

She said: “It recognises long-term stewardship and intergenerational responsibility, and draws a clear distinction between established family enterprises and short-term or speculative ownership. If the government’s aim is to target avoidance rather than punish genuine businesses, then this amendment deserves serious consideration.

“There is profound unfairness at the heart of this policy, which the government has yet to explain or justify.

“Clarity is needed! A farm worth £5 million owned by a single farmer could face a tax bill of around £500,000, while a farm of the same value owned jointly would face no tax bill at all. That is not fair; it is arbitrary and discriminatory.

“Farmers are asset rich, but cash poor. Many family farms exceed £2.5 million in value, not because they are wealthy enterprises, but because land values have risen dramatically while margins remain tight and incomes volatile.”

Concluding, Carla Lockhart MP added: “Strangford MP Jim Shannon, has outlined an estimated 25% of farms in Northern Ireland fall above that threshold. Those farms are the backbone of our economy. The move from 100% relief to 50% relief above the cap is not a minor adjustment; it is a fundamental weakening of agricultural property relief. It risks forcing families to sell land, reduce the scale of their business or take on unsustainable debt - not because their farms have failed, but because the tax system has failed them.

“People are taxed throughout their lives, on income, profits and on what they produce. To tax those same assets again, simply because someone has died, is a double whammy. It is double taxation in all but name, and penalises families at the very moment of loss. That is a principle I cannot support. A death tax is immoral.”

Share